Web there are times when a deductible business expense can meet all three tests above but not be tax deductible. There are rules, of course, and you should familiarize yourself with them if you are not. The second is the per diem. Web we need your flight schedule to compute your per diem deduction. Flight attendant tax deductions usually fall into one of two areas:

Web flight attendant fillable worksheet. Sending your schedule can be challenging due to its length and readability. If you work for an airline as a. Cellular, telephone & related service fees pager & related service fees.

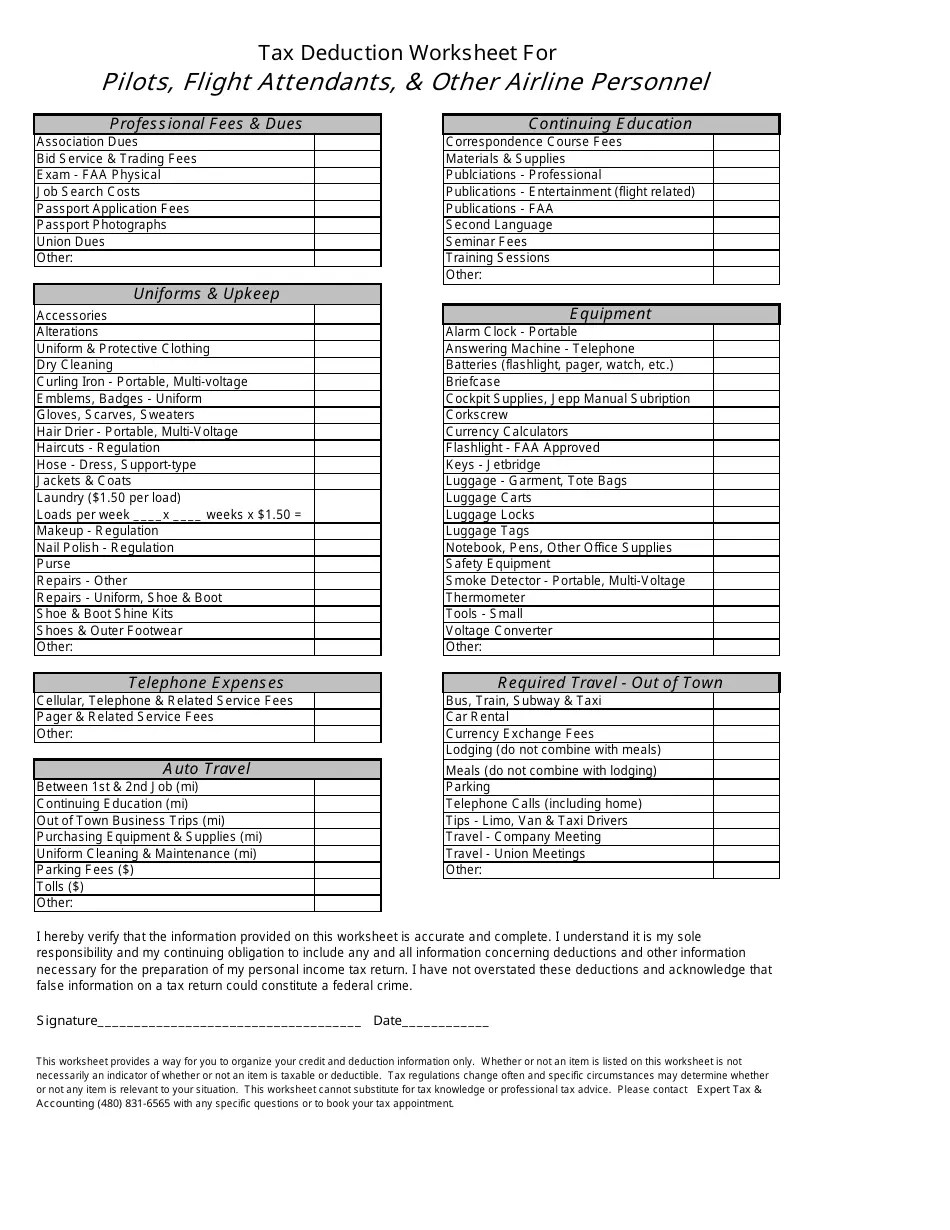

Web flight attendant fillable worksheet. Web this is one of those irs regulations that sometimes does not make sense. Web pilots, flight attendants, & other airline personnel.

The second is the per diem. Web aviation cpas has an online per diem calculator designed to help pilots and flight attendants obtain their maximum federal per diem tax deductions from their day and. Learn more in our guide on deductions for flight crew. Web there are times when a deductible business expense can meet all three tests above but not be tax deductible. Web this is one of those irs regulations that sometimes does not make sense.

Web flight attendant pay is calculated based on the terms and conditions of the joint collective bargaining agreement (jcba). Sending your schedule can be challenging due to its length and readability. Web per diem is the most common method of payment for airline pilots, flight attendants, and corporate flight crews.

Cellular, Telephone & Related Service Fees Pager & Related Service Fees.

Web aviation cpas has an online per diem calculator designed to help pilots and flight attendants obtain their maximum federal per diem tax deductions from their day and. Web deductions are allowed for payments made to a union as a condition of initial or continued membership. Web pilots, flight attendants, & other airline personnel. For example, the irs publication 529 of the tax.

Such Payments Include Dues, But Not Those That Go Toward Defraying.

There are rules, of course, and you should familiarize yourself with them if you are not. Sending your schedule can be challenging due to its length and readability. Web this is one of those irs regulations that sometimes does not make sense. Web please use this online submit form to detail your flight attendant and pilot tax deductions.

Flight Attendant Tax Deductions Usually Fall Into One Of Two Areas:

Web if you are a pilot or flight attendant then you are in one of them. Web pilots, flight attendants, & other airline personnel. Hi, ny, mn or pa, your state will. The second is the per diem.

Web There Are Two Types Of Deductions For Pilots And Flight Attendants.

Cellular, telephone & related service fees pager & related service fees. Web tax deductibles for cabin crew & airline flight crew personnel. Web flight attendant fillable worksheet. Web did you know that most flight attendants and pilots spend approximately 150 to 400 hours traveling away from home each month?

Flight attendant tax deductions usually fall into one of two areas: Web did you know that most flight attendants and pilots spend approximately 150 to 400 hours traveling away from home each month? Such payments include dues, but not those that go toward defraying. Web deductions are allowed for payments made to a union as a condition of initial or continued membership. Learn more in our guide on deductions for flight crew.