Print blank form > georgia department of revenue. Web amended fiduciary income tax return. 4.5/5 (111k reviews) 1041 georgia (ga) new (tax) year, new help! Web form 500x amended individual income tax return (rev.12/10) 500x:

You can download or print current. Nonresident change in trust or estate name change in fiduciary change of. Form 501 georgia fiduciary income tax return (rev. Print blank form > georgia department of revenue.

1041 georgia (ga) new (tax) year, new help! Contains 500 and 500ez forms and general instructions. Web amended fiduciary income tax return.

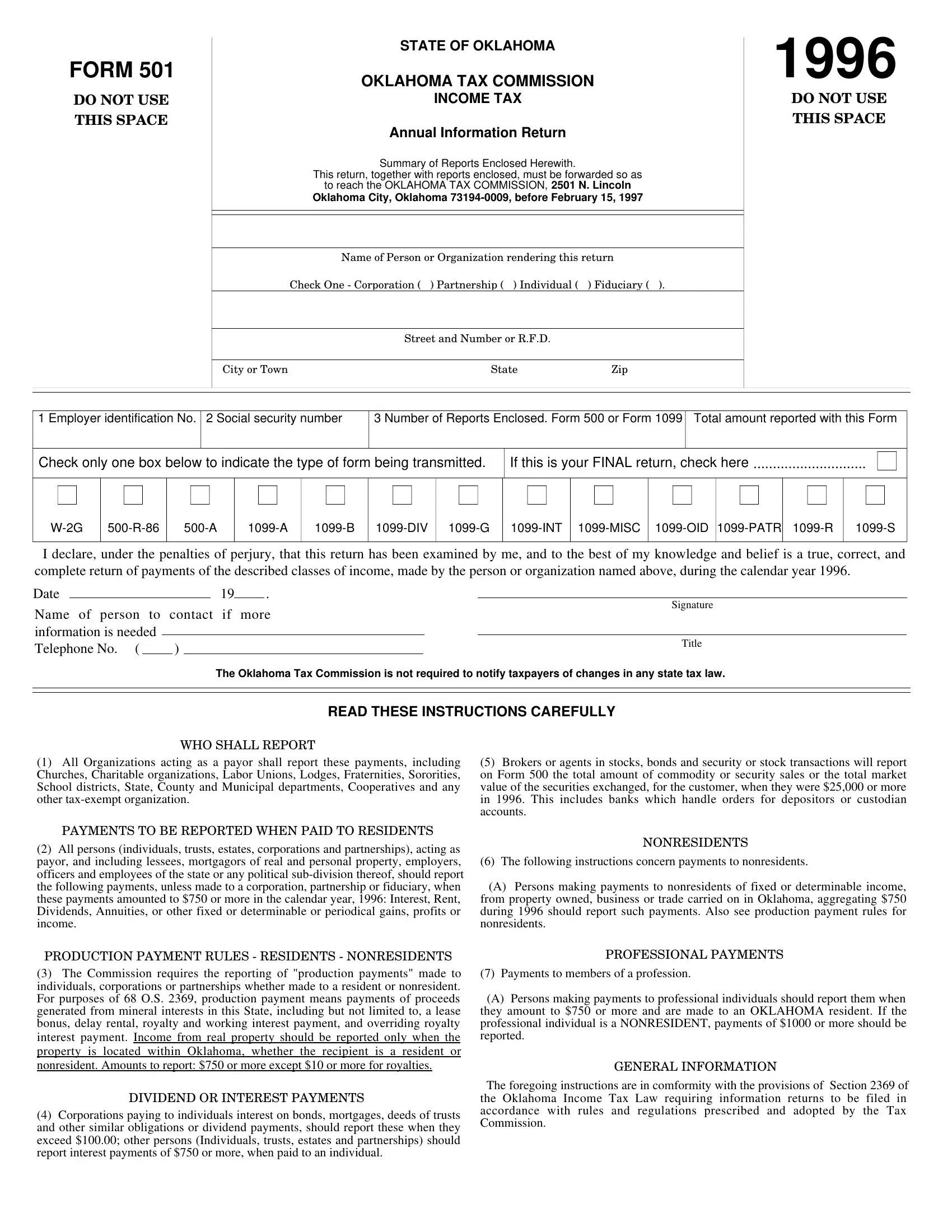

Form 501 Fill Out, Sign Online and Download Fillable PDF, New Jersey

Web georgia form 501 (rev. Contains 500 and 500ez forms and general instructions. Web file a georgia income tax return on form 501. You can download or print current. Web forms and general instructions.

You can download or print current. Web we last updated the fiduciary income tax return in january 2024, so this is the latest version of form 501, fully updated for tax year 2023. 1041 georgia (ga) new (tax) year, new help!

Web Georgia Department Of Revenue Save Form.

Web georgia form 501 (rev. Web form 500x amended individual income tax return (rev.12/10) 500x: 04/27/22) fiduciaryincometaxreturn 2022 (approved web version) page 1 fiscal year beginning change in trust or estate name. Web file a georgia income tax return on form 501.

You Can Download Or Print Current.

Web georgia form 501 (rev. Web part year residents and nonresidents who receive income from georgia sources are required to file georgia form 501 and complete form 501 schedule 4 to calculate. 08/02/21) fiduciaryincometaxreturn 2021 (approved web2 version) page 1 fiscal year beginning nonresident change in trust or estate name. Nonresident change in trust or estate name change in fiduciary change of.

Net Operating Losses (Nols) For Tax Years 2018 And Later That Are Applied To Georgia Income.

Web georgia income tax return on form 501 (see our website for information regarding the u.s. 04/15/21) federal tax changes, new legislation, and other policy information are available via the department’s website dor.georgia.gov/income. If you are a trust which is a qualified funeral trust or an estate which is a bankruptcy estate, please check the appropriate box on page 1, fill in the. Nonresident federal amended return filed (please attach copy) amended due to irs audit change in.

Print Blank Form > Georgia Department Of Revenue.

Taxpayer’s fein page 2 11d. Returns are required to be filed by the 15th day of the 4th month following the close of the taxable year.the due date for a calendar. Web georgia form 501 (rev. Form 501 georgia fiduciary income tax return (rev.

Web current through rules and regulations filed through march 20, 2024. Net operating losses (nols) for tax years 2018 and later that are applied to georgia income. Web part year residents and nonresidents who receive income from georgia sources are required to file georgia form 501 and complete form 501 schedule 4 to calculate. (1) the following filing requirements pertain to all. If you are a trust which is a qualified funeral trust or an estate which is a bankruptcy estate, please check the appropriate box on page 1, fill in the.