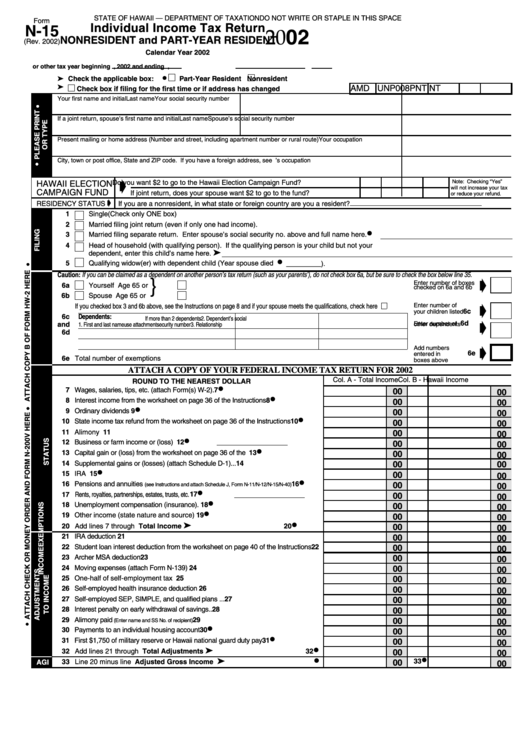

On line 13, the capital (loss). This includes nonresidents who earned. Do not write in this area. Do not write in this area. State of hawaii — department of taxation.

On line 13, the capital (loss). State of hawaii — department of taxation. For information and guidance in its preparation, we have helpful. Do not write in this area.

State of hawaii — department of taxation. Web hawaii n15 tax form. Use a hawaii n 15 tax online 2023 template to make your document workflow more streamlined.

2021) state of hawaii — department of taxation do not write in this area. For information and guidance in its preparation, we have helpful. Use a hawaii n 15 tax online 2023 template to make your document workflow more streamlined. Schedule cr schedule of tax credits; Do not write in this area.

For more information about the hawaii income tax, see the hawaii income tax page. Web hawaii tax forms by form number (alphabetical listing) hawaii tax forms by category (individual income, business forms, general excise, etc.) where to. Schedule cr schedule of tax credits;

Do Not Write In This Area.

This includes nonresidents who earned. Web hawaii n15 tax form. For information and guidance in its preparation, we have helpful. Web our website at tax.hawaii.gov.

Web Hawaii Tax Forms By Form Number (Alphabetical Listing) Hawaii Tax Forms By Category (Individual Income, Business Forms, General Excise, Etc.) Where To.

Web 52 rows simplified individual income tax return (resident form) 2023 : State of hawaii — department of taxation. On line 13, the capital (loss). This government document is issued by department of taxation for use in hawaii.

Do Not Write In This Area.

Do not write in this area. State of hawaii — department of taxation. Obsolete individual income tax return. This form is for income earned in tax year 2023, with tax returns due in april.

Schedule Cr Schedule Of Tax Credits;

For more information about the hawaii income tax, see the hawaii income tax page. Use a hawaii n 15 tax online 2023 template to make your document workflow more streamlined. State of hawaii — department of taxation. 2021) state of hawaii — department of taxation do not write in this area.

On line 13, the capital (loss). This form is for income earned in tax year 2023, with tax returns due in april. State of hawaii — department of taxation. Do not write in this area. Web 52 rows simplified individual income tax return (resident form) 2023 :