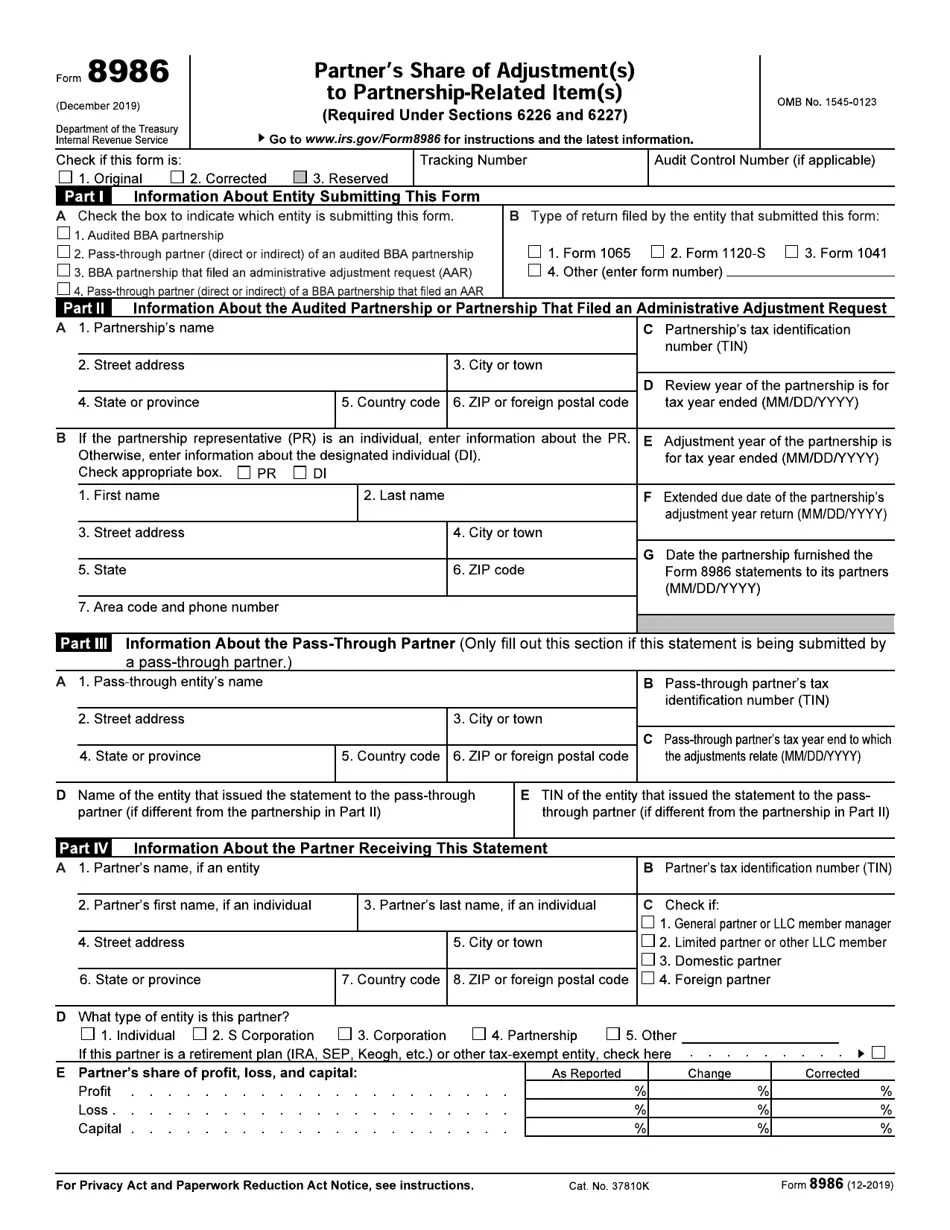

Web partners receiving form 8986 must file form 8978 to report additional tax due as a result of examination adjustments. How do i generate federal form 8986 in a 1065 return using cch® prosystem. Please see the following knowledgebase article: Increased numbers of partnership audits and more partnerships filing administrative adjustment requests (aars) means more taxpayers will receive. Form 8986 is used by the audited partnership to push out imputed underpayments to its partners.

I understand there is a timing difference between the year of the original form. Form 8986 can also be. How do i generate federal form 8986 in a 1065 return using cch® prosystem fx® tax and cch axcess™ tax? How do i generate federal form 8986 in a 1065 return using cch® prosystem.

How do i generate federal form 8986 in a 1065 return using cch® prosystem fx® tax and cch axcess™ tax? Web who should prepare form 8986. Web form 8986 is generated using the following input:

A partnership that properly elects to push. Web form 8986 is an essential document for taxpayers who need to make adjustments or corrections to their previously filed tax returns. How do i generate federal form 8986 in a 1065 return using cch® prosystem fx® tax and cch axcess™ tax? Anytime a corrected form 8986 is submitted a corrected form 8985 must also be included. Schedule a is also used to report any related amounts and adjustments not reported on.

How do i generate federal form 8986 in a 1065 return using cch® prosystem fx® tax and cch axcess™ tax? The purpose of the form is to restate income and capital. Web turbotax does not support this form, unfortunately.

Web Form 8986, You Will Need To Submit Two Corrected Forms:

The purpose of the form is to restate income and capital. Increased numbers of partnership audits and more partnerships filing administrative adjustment requests (aars) means more taxpayers will receive. Web form 8986 is an essential document for taxpayers who need to make adjustments or corrections to their previously filed tax returns. Form 8986 is used by the audited partnership to push out imputed underpayments to its partners.

Web Partners Receiving Form 8986 Must File Form 8978 To Report Additional Tax Due As A Result Of Examination Adjustments.

Web what to do upon receipt of a form 8986. Web who should prepare form 8986. Schedule a is also used to report any related amounts and adjustments not reported on. Instructions for partners that receive form 8986.

Multiple Forms May Be Obtained, Covering.

Real estatehuman resourcesall featurescloud storage 6226 and administrative adjustment requests (aars) under sec. Please see the following knowledgebase article: A partnership that properly elects to push.

(1) A Corrected Form 8986 With The Correct Tin, And (2) A Corrected Form 8986 With The Incorrect Tin And Zeros In Part Iv Sections E Through G, And In Part V.

I understand there is a timing difference between the year of the original form. Web form 8986 is a bba form used by a partnership to report each partner’s allocable share of partnership adjustments. Where to submit form 8986. Web the schedule a (form 8978) lists all the adjustments a partner receives on form 8986.

Web the schedule a (form 8978) lists all the adjustments a partner receives on form 8986. Anytime a corrected form 8986 is submitted a corrected form 8985 must also be included. Web form 8986, you will need to submit two corrected forms: Please see the following knowledgebase article: Multiple forms may be obtained, covering.