• stock in new jersey corporations; For release of nj bank accounts, stock, brokerage accounts and investment bonds. Stock in new jersey corporations; Class d beneficiaries can receive $500 tax free. Answered on 6/02/09, 8:08 am.

Web the tax waivers function as proof to the bank or other institution that death tax has been paid to the state, and money can be released. Hnw april 6, 2024 estate administration and probate. This form cannot be used for real estate. An estate tax return must be filed if an unmarried person dies and his or her estate exceeds.

This form cannot be used for real estate. Web for all dates of death prior to january 1, 2018. Web using the appraised date of death value and the date of death values of your uncle’s other assets, you — or more likely, a tax preparer such as an accountant — will be able to prepare and file the.

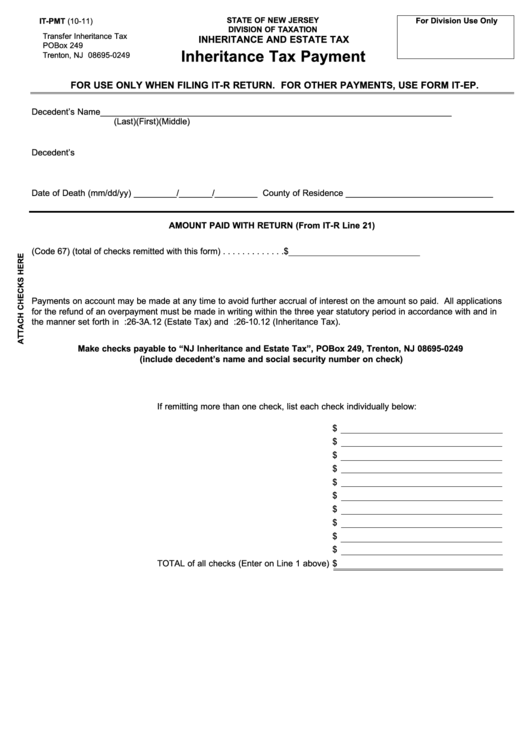

• stock in new jersey corporations; Answered on 6/02/09, 8:08 am. Transfer inheritance and estate tax. Hnw april 6, 2024 estate administration and probate. A waiver from the new jersey division of taxation releasing property where located from the inheritance taxes.

Web for all dates of death prior to january 1, 2018. Go to the nj government website site and search under tax info. Web here’s a quick summary of nj waiver requirements before the transfer of a decedent’s property.

• New Jersey Bank Accounts;

Each waiver will contain specific information about the property (such as: (bank accounts, stocks, bonds, and brokerage accounts) Stock in new jersey corporations; This form cannot be used for real estate.

Web A Separate Waiver Will Be Issued For Each Asset.

An estate tax return must be filed if an unmarried person dies and his or her estate exceeds. This form is specifically designed for reporting assets acquired through an estate and provides a detailed breakdown of the inherited property. For real estate investments, use. Web this form may be used when:

Hnw April 6, 2024 Estate Administration And Probate.

Web one way to obtain the tax waiver is to file a completed inheritance tax return. Download your updated document, export it to the cloud, print it from the editor, or share it with others using a shareable link or as an email attachment. Jonathan chester the law office of jonathan s. This form can only be issued by the division of taxation.

The Fill In Cover Sheet Form Is Available At This Link:.

Funds held in new jersey financial institutions; The form you want is on the internet. Transfer inheritance and estate tax. Web executor’s guide to inheritance and estate taxes forms pay tax tax waiver requirement.

O to get this form, you must file a return with the division. Web executor’s guide to inheritance and estate taxes forms pay tax tax waiver requirement. New jersey has had an inheritance tax since 1892, when a tax was imposed on property transferred from a deceased person to a beneficiary. Transfer inheritance and estate tax. An inheritance tax return must be filed if money is inherited by anyone other than a spouse, child or charity.