Web form 2159 (may 2020) payroll deduction agreement (see instructions on the back of this page.) department of the treasury — internal revenue service catalog number 21475h www.irs.gov. Payroll departments may also receive court orders directing them to withhold a set. I understand and agree that any amount that is due and owing at the time of my Food, tools, supplies, phone, etc.) ☐ supplies or equipment purchase: The authorization must be clear and specific to the amount that is being deducted and its purpose.

Payroll departments may also receive court orders directing them to withhold a set. Instantly download payroll deduction authorization form template, sample & example in microsoft word (doc), google docs, apple pages format. Web a payroll direct deposit authorization form allows employers to send money to employees’ bank accounts. Web payroll deduction authorization form template.

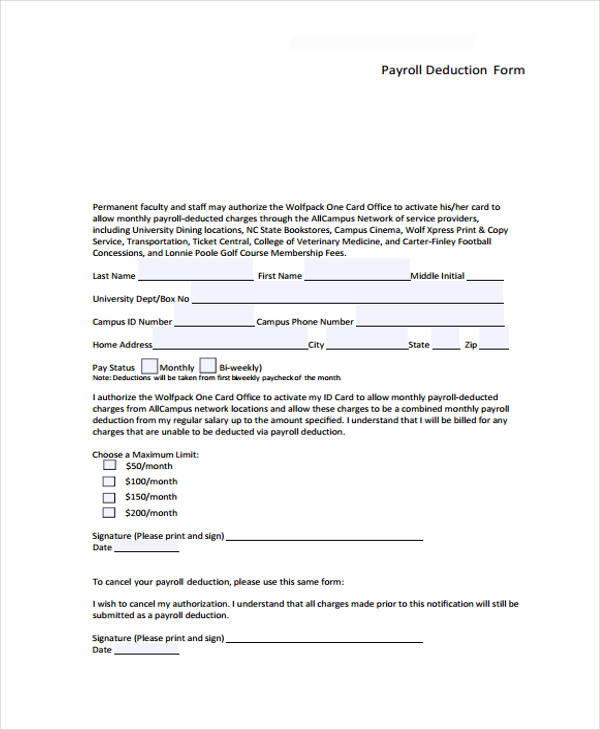

Employee name * department * marketing. Web a payroll deduction form is a crucial document used by employers to authorize regular deductions from an employee’s paycheck. I authorize [company name] to withhold from my wages the total amount of $ [amount] which shall be withheld at a rate of $ [amount.

Instantly download payroll deduction authorization form template, sample & example in microsoft word (doc), google docs, apple pages format. $ per paycheck for the next paycheck(s) ☐ uniform rental and cleaning: Web employee payroll deduction authorization. Web form 2159 (may 2020) payroll deduction agreement (see instructions on the back of this page.) department of the treasury — internal revenue service catalog number 21475h www.irs.gov. Employees can use authorize deduction from their payroll with this form.

Web ☐ frequently recurring deductions: Web payroll deduction authorization employee name employee id number ( last name ) ( first name ) ( middle initial ) ssn date of birth account number work phone personal phone employer name pay frequency ( x ) list amounts to allocate to the following accounts: Web a payroll deduction form is a crucial document used by employers to authorize regular deductions from an employee’s paycheck.

Web Payroll Deduction Authorization Form Template.

Not to exceed $ per paycheck without additional authorization for (ex: Food, tools, supplies, phone, etc.) ☐ supplies or equipment purchase: (employer name and address) regarding: Tandem payroll ltd, 5 lancing.

Always Keep Copies Of Letters On The Employee’s File.

Web form 2159 (may 2020) payroll deduction agreement (see instructions on the back of this page.) department of the treasury — internal revenue service catalog number 21475h www.irs.gov. Web for your group rrsp. Type of deduction total requested amount deduction amount per pay period. The authorization must be clear and specific to the amount that is being deducted and its purpose.

Web This Form Can Be Used To Authorize New Benefit Deductions, Request Changes To Current Deductions And/Or Cancel Benefit Deductions.

Payroll departments may also receive court orders directing them to withhold a set. Most employers ask employees to provide a voided check when completing the form, as it provides the aba routing number that identifies the employee’s bank and account number. Web employee payroll deduction authorization. Web a payroll deduction form is a crucial document used by employers to authorize regular deductions from an employee’s paycheck.

This Payroll Deduction Form Is Designed For Authorizing Voluntary Deductions Such As Retirement Or Health Care Savings.

I hereby authorize the above deductions. Employee signature date / / title: Web payroll deduction authorization employee name employee id number ( last name ) ( first name ) ( middle initial ) ssn date of birth account number work phone personal phone employer name pay frequency ( x ) list amounts to allocate to the following accounts: Get authorization from an employee to make payroll deductions by having them sign this free downloadable form.

Web a payroll deduction form is a crucial document used by employers to authorize regular deductions from an employee’s paycheck. Web download the most common forms, tables and helpbooks for setting up and running a payroll system with or without payroll software. This payroll deduction form is designed for authorizing voluntary deductions such as retirement or health care savings. This form can cover a wide range of deductions, from health insurance premiums to retirement plan contributions, ensuring transparent and accurate financial transactions between employers and employees. Always keep copies of letters on the employee’s file.