Under section 75 you can claim against your credit card provider when goods you've bought with a credit card develop a fault. Web this means you'll need to send in a formal dispute letter by mail (yes, snail mail) within 60 days of the disputable charge. Web [company name] [street or p.o. Use this template letter to make a claim. Below is a sample letter you can use when you need to dispute credit card charges.

Web i am writing to dispute a charge of [$_____] to my [credit or debit card] account on [date of the charge]. How to write a dispute letter. Your card provider may have a set process for submitting a claim for a refund of a disputed transaction. Learn how the cfpb can help you.

If you can’t settle the matter directly with your customer, we’ll take an independent look. Letter to ask a bank for repayment of a disputed transaction. Web if you suspect you are the victim of credit card fraud, you can use a letter to dispute a fraudulent credit card transaction to help fix things.

Web letter to report a problem with something bought on credit card. Web i am writing to dispute a charge of [$_____] to my [credit or debit card] account on [date of the charge]. Signing up for purchase alerts can help. If you can’t settle the matter directly with your customer, we’ll take an independent look. Web if an unauthorized or duplicate charge has appeared on your credit card bill, you can write a dispute letter to get it investigated.

If you can’t settle the matter directly with your customer, we’ll take an independent look. Consumers free weekly credit reports through annualcreditreport.com. Be sure to customize the letter with your personal information, including your credit card account number or at least the last four digits of the account number.

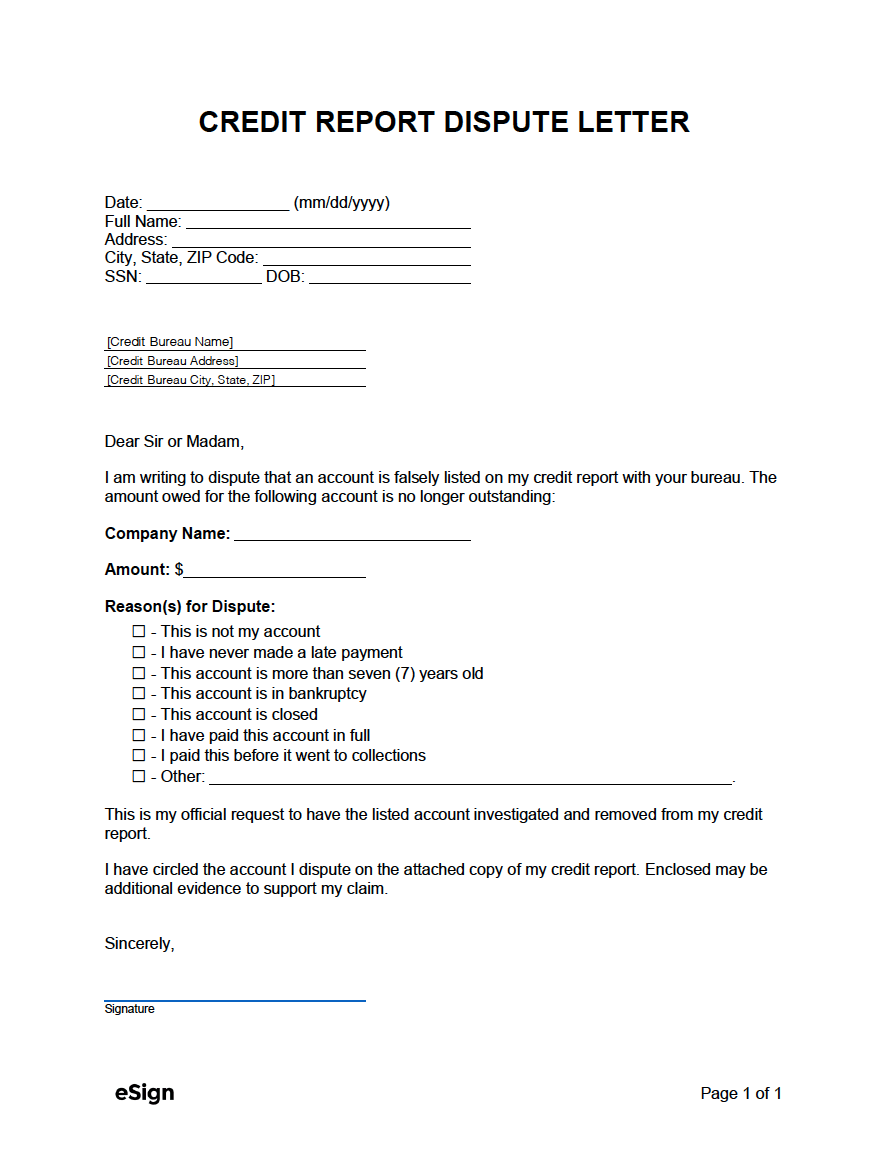

Dispute An Item On A Credit Report.

Government agency that makes sure banks, lenders, and other financial companies treat you fairly. Your statement will list the merchant’s name and also, typically, the. You may have just 60 days from the time you receive your credit card bill to dispute a charge. Below is a sample letter you can use when you need to dispute credit card charges.

Web Below Is A Sample Letter You Can Use For Credit Card Billing Disputes (Not For Credit Report Errors, Which Require A Different Kind Of Letter).

This letter should clearly identify the disputed transaction, explain why it is being disputed, and request an investigation and correction of the error. The charge is in error because [explain the problem briefly. Web while you may be able to dispute these charges over the phone, some companies may also require you to send a written, more formal letter to explain the issue and why you are not responsible for the credit card debt. This includes your account number, the disputed amount, the date of the charge, and any evidence supporting your claim (receipts, emails, etc.).

Failure To Send Bills To Your Current Address.

Failure to post payments or other credits, such as returns. | last reviewed january 22, 2024. How to write a dispute letter. Be sure to customize the letter with your personal information, including your credit card account number or at least the last four digits of the account number.

So Keep Close Tabs On Your Statements And Check Carefully For Suspicious Transactions.

Filing a letter to dispute a fraudulent credit card. | legally reviewed by melissa bender, esq. Signing up for purchase alerts can help. Credit, banking, and debt relief / sample billing dispute letter.

Failure to post payments or other credits, such as returns. This letter should clearly identify the disputed transaction, explain why it is being disputed, and request an investigation and correction of the error. Dispute an item on a credit report. Be sure to customize the letter with your personal information, including your credit card account number or at least the last four digits of the account number. Your statement will list the merchant’s name and also, typically, the.

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://i2.wp.com/templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-41.jpg)