Eligible goods and conditions for relief. Firstly, you need to register with hm revenue and customs ( hmrc) for the scheme, and you can do this online. Rishi sunak is reportedly mulling a cut to stamp duty in the autumn statement as part of a. Data element 2/3 documents and other reference codes (national) of the customs declaration service (cds) find a list of codes for the relevant document codes, document status codes. Web cds your own top up account allowing you to pay your import duty and/or vat.

Cds usage requires a separate direct debit to be. Web if no, go to the declaration on page 4. It’s a crucial part of the home buying process, and it’s essential to understand how it works. Available on chief and cds.

Stamp duty land tax (sdlt), applying to transactions in land and buildings in england and northern ireland. Web circular date stamp (cds): There are exemptions and reliefs such as the annual exempt amounts.

You can apply if you’re the person using the goods or you’re arranging an import declaration for the goods to be used on your behalf. Firstly, you need to register with hm revenue and customs ( hmrc) for the scheme, and you can do this online. In ta terms we say you are trading in your stamps. Set up or view an authority on the customs declarations service. Cds cash account your own credit account allowing you to pay your import duty and/or vat.

Web the five stamp taxes are: Using temporary admission in great britain. Web the treasury is considering raising the threshold from £250,000 to £300,000 credit:

Stamp Duty Land Tax (Sdlt), Applying To Transactions In Land And Buildings In England And Northern Ireland.

Web the five stamp taxes are: It’s a crucial part of the home buying process, and it’s essential to understand how it works. Cds—certificates of deposit—provide holders with taxable interest income. In this article, we’ll delve into the ins and outs of stamp duty.

A Tab Which Unites Two Sections From A Roll Of Stamps.

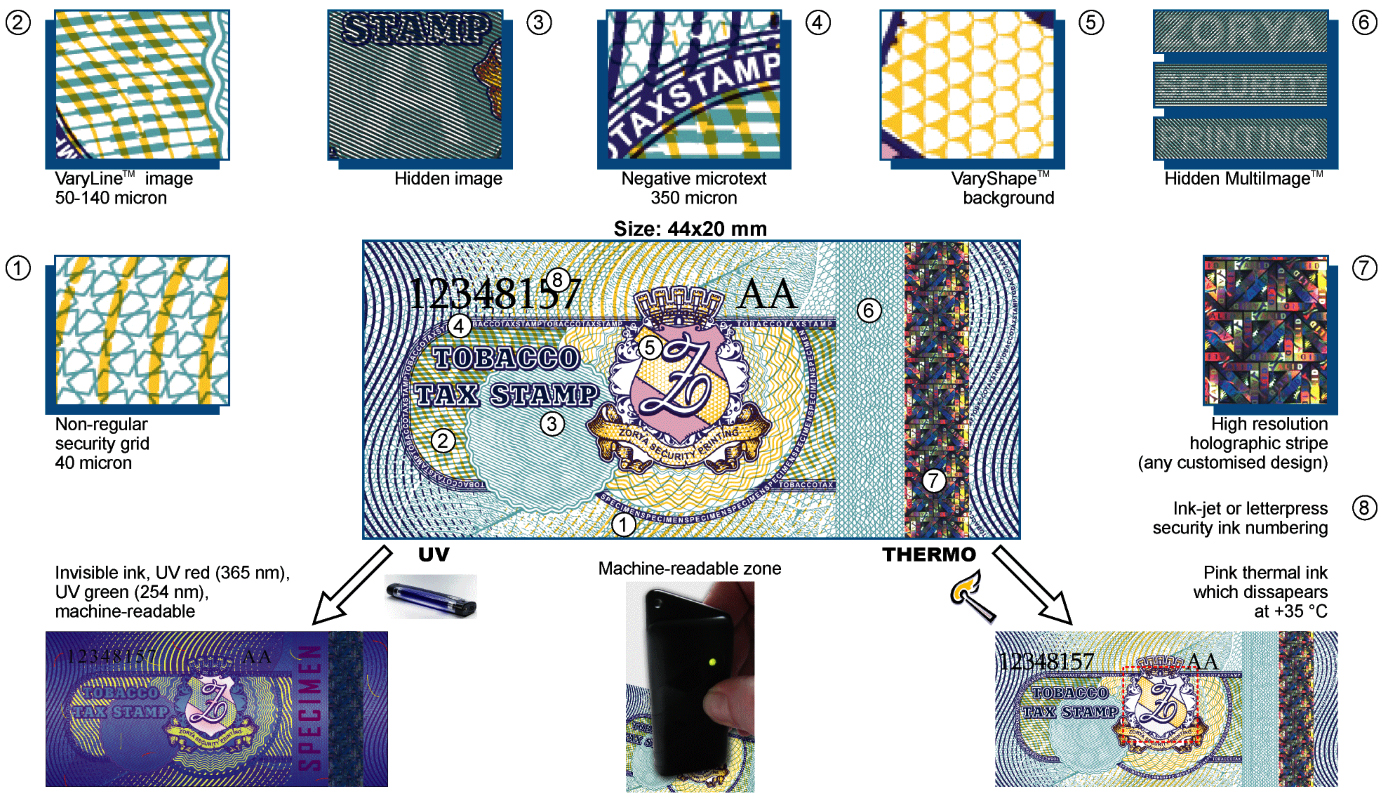

Under the scheme, bottles of spirits, wine or made wine (over 30%abv) destined for sale in the uk must carry a stamp to indicate. What makes up the ata carnet. Web 17 april 2024 — see all updates. Rishi sunak is reportedly mulling a cut to stamp duty in the autumn statement as part of a.

Web Hm Revenue & Customs.

Remember, not all capital gains are subject to cgt. Get emails about this page. Find out how to give or view an authority to use deferment, guarantee or cash account to import goods. Available on chief and cds.

Register For A Government Gateway (Gg) Account.

The duty stamps scheme applies to products with an alcohol. Web uk duty stamps scheme. Web cds your own top up account allowing you to pay your import duty and/or vat. You can apply if you’re the person using the goods or you’re arranging an import declaration for the goods to be used on your behalf.

Web the five stamp taxes are: Web the treasury is considering raising the threshold from £250,000 to £300,000 credit: If you act on behalf of more than one principal, complete the continuation sheet at appendix d, page 6. Eligible goods and conditions for relief. Web hm revenue & customs.