Web fill in the wt1 form and send it to hmrc with your company tax return if: Web we advise that if you save a declaration and then send in a paper declaration for the same period that you delete the saved declaration from the ‘open periods’ list. Web if your tax code has ‘w1’ or ‘m1’ or ‘x’ at the end. You will fill this form in online and you cannot save your progress. Tax codes with ‘k’ at the beginning mean you have.

Work out your new employee's tax code. Web enter on page 10 of the w1, details of eads which have become outstanding after 2 months from date of despatch (that is, no report of receipt/export has been received) during the. You may be put on an emergency tax code if hmrc. 1257l is known as the emergency code and can also be given on a cumulative basis or on a week 1 (w1) or month 1 (m1).

You will fill this form in online and you cannot save your progress. Through the xml direct submission service. These are emergency tax codes.

These transaction forms are for use in business and residential property sales. Web if your tax code has ‘w1’ or ‘m1’ or ‘x’ at the end. Web notes to help you complete form w1 excise warehouse return. Web how to submit your return. Below are forms commonly associated with employment taxes;.

You can submit your returns: Web department of revenue and taxation. Registration number of owner or duty.

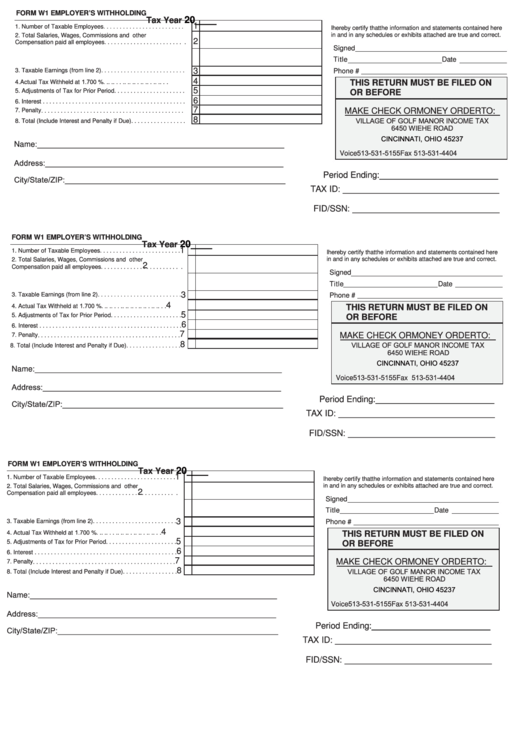

Total Wages Earned By Employees For Work That Was Performed Within Louisville Metro, Ky.

Web how to submit your return. Web fill in the wt1 form and send it to hmrc with your company tax return if: If your tax code has a ‘k’ at the beginning. Guam drt driver's handbook (1.4mb) tax preparer.

You May Be Put On An Emergency Tax Code If Hmrc.

Tax codes with ‘k’ at the beginning mean you have. If you have any problems completing the form contact the vat and. Self assessment tax return forms. Find out the requirements, deadlines, and instructions for louisville metro revenue commission.

Web Enter On Page 10 Of The W1, Details Of Eads Which Have Become Outstanding After 2 Months From Date Of Despatch (That Is, No Report Of Receipt/Export Has Been Received) During The.

Web payg withholding, payers (generally businesses and other enterprises) must withhold tax from certain payments made to others. You need to work out which tax code and starter declaration to use in your payroll software when you take on. You can submit your returns: Through the xml direct submission service.

Web If Your Tax Code Has ‘W1’ Or ‘M1’ Or ‘X’ At The End.

Web we advise that if you save a declaration and then send in a paper declaration for the same period that you delete the saved declaration from the ‘open periods’ list. Some forms are only available. Web if your tax code ends in ‘w1’ or ‘m1’ or ‘x’ you’re on an emergency tax code. Your online return doesn’t include an.

Web please read w1 notes before you complete this form. Web fill in the wt1 form and send it to hmrc with your company tax return if: You haven’t sent your company tax return online. Write clearly in black ink and use capital letters. If you have any problems completing the form contact the vat and.